Solar PV boosts Australian resources demand and maybe the CO2!!

I want to share you with an excellent video published by Martin Green (NSWU) approaching of the future forecast of Australian Mining market variations linked to world Solar PV market evolution. The video points to a $6.7 bn annually increase of income in Australian mineral resources sector by mid 2020 due to the world production of 1 TWp world installation.

Three years ago I studied the case of Chilean Copper market and the figures were impressive, numbers I published in two Peruvian business magazines you can check in the following links:

- «Renovables, Paraíso de la Minería» (August 2016; «Renewables, Paradise for Mining». Energía y Negocios 2016).

- «Energía Verde para la Minería» (May 2017; «Geen Energy for Mining» Energiminas Magazine; Peru)

I included not only solar but wind generation, transport and energy storage with requirements of 240 million tonnes of Copper to transform all the current coal fired power plants in the World into solar PV plant because the needs for copper in power capacity are 4 to 6 times and the needs in electricity production reach to 16 – 20 more than coal-fired thermal electricity production.

Martin Green Analysis, is Solar PV great business for mining commodities?

The conclusions of the analysis of Professor Martin Green and 2017 IRENA which presumes an annual 1TWp of Solar PV global installations during mids 2020, are the following:

- Australian thermal coal exports earnings will lost $1.5bn/yr

- Coking Coal (16 million tones for 1TWp Solar PV) , 6% world market, will increase earnings for $ 1.2 bn/yr

- Iron Ore (56 million Tones for 1TWp Solar PV) which means will increase earnings for $ 1.6 bn/yr

- Aluminum, 19 million Tn for frames and supports (38 mill. tonnes of Alumina) will increase earnings for $ 3.3 bn/yr

- Copper, 5 million Tones (5 Tn/MWp) which means $2.1 bn/yr of increased earnings for Australian mining.

Therefore the annualized PROFIT AND LOSS figures for Australian Mining should be:

- Losses for $1.5 bn

- Increased revenues for $8.2 bn

- Profits: $6.7 bn

6.7 billion USD of Profits in Australian Mining Sector, not bad news for miners!!

Derivative Analysis

Other Markets to be considered

To better analyze how renewables will affect to Australian mining commodities, we also have to take into account:

- the generation site for wind energy (using from 4 Tn -onshore- to 18Tn -offshore- of Copper each wind MWp installed)

- the transmission market will increase copper / aluminium use in new distributed grid topology versus centralized current ones

- the energy storage market for batteries market (lithium, graphite, Cobalt, Iron Ore, Vanadium …)

- the electric vehicle market

In analyzing CO2 emissions production, we need to study the «hidden emissions» linked to the production of these minerals and metals to produce pv panels, windmills and so forth.

And other mineral products as quartz sands for low iron glass used in solar PV, quartz for solar silicon production and Cement.

What about the power to produce this «Solar» Iron Ore, Copper and Aluminum?

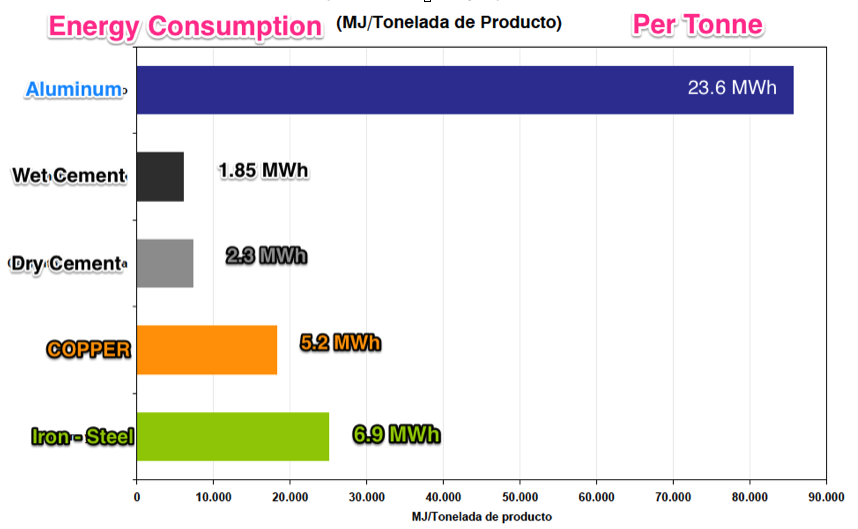

Figure: Energy consumption to produce Aluminum, Cement, Copper and Iron - Steel in MJ/Tn transformed into MWh/Tn

Copper

Current Copper production in Chile, Peru, Mexico, US, Africa, Australia combined with smelting in other countries (China, South Korea or Japan) for copper cathodes (99.99) requires an average of 5.2 MWh of electricity per tone of metal. In the case of Chile in mids 2020 the requirements will increase to 6-9 MWh/Tn mainly due to mine aging, desalination and pumping water to the mountains.

Current needs for Copper mining (smelting) to produce 1 TWp Solar PV are 5 million tones. Making the conversion of 5.2 MWh/Cu Tn results in 26 TWh of electricity in mining and / or smelting copper.

- Produce the copper needed for 1TWp Solar PV installations requires more energy than the annual electricity consumption of IRELAND (25 TWh/yr)

Alumininum

The Case of Aluminium is even worse: 19 million Tn per TWp solar PV and 23.6 MWh / Al tone deals to 448.4 TWh/yr. 98% of this needs aren’t linked to Bauxite mining production. It is basically smelting.

- Produce the aluminium needed for 1TWp Solar PV installations requires more energy than the annual electricity consumption of FRANCE (431 TWh/yr 2014)

The Economist 2012: "6% of China's electricity demand is linked to the Aluminium smelting sector".

Iron Ore – Steel

In doing so with Iron Ore & Steel we need 6.9 MWh / Steel tone. Today, it is estimated that the global steel industry uses on average 2 billion tonnes of iron ore, 1 billion tonnes of metallurgical coal and 520 million tonnes of recycled steel to produce 1.6 billion tonnes of crude steel, a year. Then those 60 million Tn of Iron Ore to produce 1TWp of Solar PV will implies 48 million Tn of steel. And this steel will need (48 x 6.9) 331.2 million MWh or 331.2 TWh of electricity requirements.

- Produce the steel needed for 1TWp Solar PV installations requires more energy than the annual electricity consumption of UNITED KINGDOM (309 TWh/yr 2014)

The Bundle: Copper + Aluminum + Iron Ore (Steel)

Iron Ore, Copper and Aluminium annual needs for the annual production of 1 TWp of Solar PV

- 26 TWh for Copper production to install 1TWp of Solar PV

- 448.4 TWh for Aluminium production to install 1TWp of Solar PV

- 331.2 TWh for Steel (Iron Ore) production to install 1TWp of Solar PV

- Total: 805.6 TWh to produce the «Cu-Al-Fe Bundle» for 1TWp of Solar PV

Which means:

- Produce the Cu+Al+Fe Bundle needed for 1TWp Solar PV installations requires more energy than the annual electricity consumption of GERMANY (533 TWh/yr 2014) or

- 3.7% of World electricity consumption by 2014

- In other words the 13.61% of China, 20.6% USA, 29.1% EU, 75% Russia , 80.5% India or 86.25% of Japan

The Discussion, what about the use of renewables by mining companies?

Mining countries, especially based on metals, will have huge opportunities to develop new production sites thanks to the renewable and energy storage industries, so it would be logic that mines begun to use renewables for their self-consumption as a mainstream habit for the sector. We have a good model in the Clouding sector having similar percentage of OPEX energy cost, we see Google, Apple, Amazon … no only consuming renewable energy but investing huge amounts of capital in the clean markets. And what about miners? Are they producing Coca Cola and drinking Pepsi Cola? Do you imagine the President of Coca-Cola drinking Pepsi-Cola?

Do you imagine the President of BHP or Rio Tinto doing business with «renewable metals» using fossil fuels? Yes is Business As Usual

… this is the way of most mining companies approach to renewables, it’s great for the business … but we don’t use it!!

Visit and become a member of LinkedIn Group:

Renewable Energies for Mining and Oil Industry